Grasping Tax Rules for Equipment Purchasers

본문

When acquiring gear for your enterprise, tax consequences may rival the initial expense.

Across numerous nations, the method of recording the purchase in financial and tax records can reduce the amount of tax you owe, speed up cash flow, or even make you eligible for special incentives.

Understanding the tax regimes that apply to equipment buyers is therefore essential for taking wise buying choices and staying compliant with jurisdictional standards.

Critical ideas for equipment buyers

Depreciation rules

Nearly all tax frameworks allow businesses to recoup the expense of a capital asset across its useful life through depreciation. Depreciation schedules and techniques differ across regions. Standard practices involve straight-line, declining balance, and accelerated depreciation. In some countries, you can even write off the entire purchase in the year you buy it—known as a "first‑year deduction" or "Section 179" in the United States.

Bonus depreciation and ITCs

A few governments grant bonus depreciation, allowing a larger initial deduction. In the United States, 100 % bonus depreciation, effective through 2022, is being reduced to 80 % in 2023, 60 % in 2024, 40 % in 2025, and 20 % in 2026. Investment tax credits (ITCs) are another tool that can offset a portion of the purchase price, especially for renewable‑energy equipment such as solar panels.

Capital allowance regimes

In many European, Asian, and African countries, the concept of "capital allowances" replaces the U.S. terminology Depreciation durations and rates differ by industry, asset category, and company size. Identifying whether your jurisdiction employs a flat rate, declining balance, or particular "bonus" allowances affects the speed of investment recovery.

Tax holidays and incentives

Certain equipment classes, particularly those supporting sustainability, innovation, or efficiency, may receive tax holidays. A tax holiday exempts a company from paying corporate income tax for a set number of years after a qualifying capital investment. Additionally, local governments may grant property tax rebates, decreased sales tax, or even funding that diminishes the net purchase price.

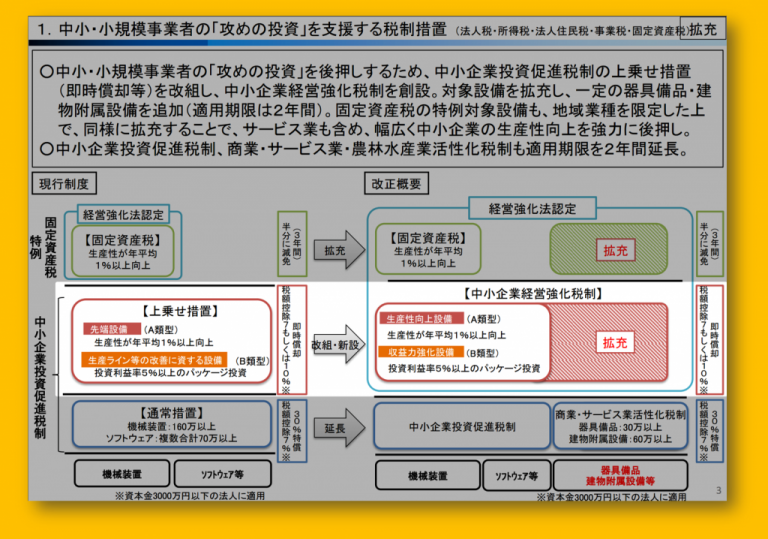

Tax treatment for small vs. large enterprises

Tax rules vary significantly between small and large firms. In the U.S., for example, small businesses can benefit from the aforementioned Section 179 deduction up to a certain dollar limit. Larger companies, on the other hand, are generally restricted to depreciation methods and must comply with more stringent reporting requirements. Other jurisdictions have similar tiered rules, so it is essential to determine which regime applies to your business size.

International trade tax effects

When importing gear, you might face duties, VAT, or excise taxes in addition to domestic regimes. However, many countries offer duty‑free or reduced‑rate treatment for equipment that qualifies under certain categories, such as energy‑efficient machinery. Additionally, the taxation of the imported equipment after use—if it can be depreciated, its useful life, and available tax credits—must be evaluated against the tax laws of both the exporting and importing nations.

Practical steps for equipment buyers

Determine the jurisdiction(s) where the equipment will operate.

Determine the asset class of the equipment (e.g., machinery, software, renewable energy).

Review the depreciation timetable and any bonus or accelerated options.

Search for tax credits, incentives, or tax holidays that could apply.

Hire a local tax expert or accountant to confirm eligibility and assemble needed documents.

Store thorough documentation of the purchase, including invoices, shipping records, and certifications that validate incentive eligibility.

Common mistakes to avoid

Believing a uniform depreciation rate for all asset categories.

Failing to document the equipment’s use and location, which can trigger audits.

Overlooking the impact of changes in tax law—such as the phased‑down bonus depreciation in the U.S. or new environmental incentive programs in the EU.

Confusing income‑tax depreciation with property‑tax allowances.

Overlooking the tax implications of leasing versus purchasing equipment.

The importance of tax regimes

The selected tax regime can alter cash‑flow timing, repayment length, 期末 節税対策 and ultimately investment returns. A solid tax plan can turn a $100,000 machine into tax savings that boost ROI and maintain competitiveness. Without proper understanding, a regime can result in lost deductions, extra cash outlays, or penalties for non‑compliance.

Bottom line

Tax regimes are central to procurement, not a marginal detail. By understanding depreciation rules, incentive programs, and jurisdiction‑specific nuances, you can make smarter purchasing decisions, secure faster cash flow, and stay in good standing with tax authorities. Whether purchasing a factory robot, delivery fleet, or solar array, tax handling will define actual cost and real value.

댓글목록0

댓글 포인트 안내